The very sharp contraction in international trade was the main factor in transmitting the crisis from the industrialised countries to the emerging countries. The shock wave did indeed hit the emerging countries, but they were able to react, some better than others. They notably undertook large-scale countercyclical monetary and budgetary policies as early as the start of 2009. One of the most notable cases has been achieved in Turkey.

The Economist pointed out that Turkey has weathered the credit crunch better than other emerging economies. Partly thanks to tough regulation, not a single Turkish bank has gone under. That is also because, unlike many Western banks, they have few toxic assets and limited mortgage exposure. So the government has not had to divert public money into rescuing banks

The Turkish Government economic stimulus measures taken have gone in two paths: monetary and budgetary policies:

In the first case, Turkey is the country that has undertaken the greatest easing of monetary policy in the world, with a drop of 1025 basis points in the key rate between November 2008 and December 2009. Turkey has shown excellent foreign currency liquidity risk management without turning to the IMF.

Other budgetary efforts such as temporary tax cuts on housing or automobiles led to a dynamic household consumption of more than 8%in the last semester of this year. This and investment during the 2010 should lead to a growth rate of nearly 7%.

The strong path of the economy had a reflect in companies as the share prices in Turkey doubled the last 12 months obtaining one of the strongest increases worldwide.

Having in mind all the ongoing problems of the sovereign debt in the European countries, another significant point is that Turkey’s debt has been increase up to two grades for the Big Three international agencies.

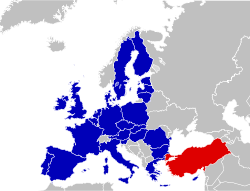

Seems that for the future months the burden of the Turkish economy of a high current account deficit and high external debt is being eased and that further economic and judicial reforms and prospective EU membership are expected to continue boosting foreign direct investment and the economy of the country.

Comentarios